Bank of Canada interest rate

The consensus points to 075 percent come September 7. The Bank of Canada today published its 2022 schedule for policy interest rate announcements and the release of the quarterly Monetary Policy Report.

Bank Of Canada Signals Hikes Coming Soon Leaves Key Interest Rate Unchanged Reuters

Bank of canada interest rate announcement 1 global newsBank of Canada increases policy interest rate by 100 basis points continues quantitative tightening.

. Our renewed monetary policy framework In 2021 we renewed Canadas flexible inflation-targeting framework for 2022 to 2026. Rather we have responsibilities for Canadas monetary policy bank notes financial system and funds management. More than three quarters of experts predict at least another two rate raises to follow in 2022.

By Josh Rubin Business Reporter Tue Sept. The Bank of Canada is set deliver a fourth consecutive outsized interest-rate hike to slow the nations economy and drag inflation down from four-decade highs. A press release will provide a brief explanation of the decision.

Photo by Blair GableReutersFile Photo Article content. According to our forecasts and in line with consensus forecasts this would still leave Canadas key policy rate below the headline rate of inflation. All experts 100 forecasted the overnight rate to increase 13 July.

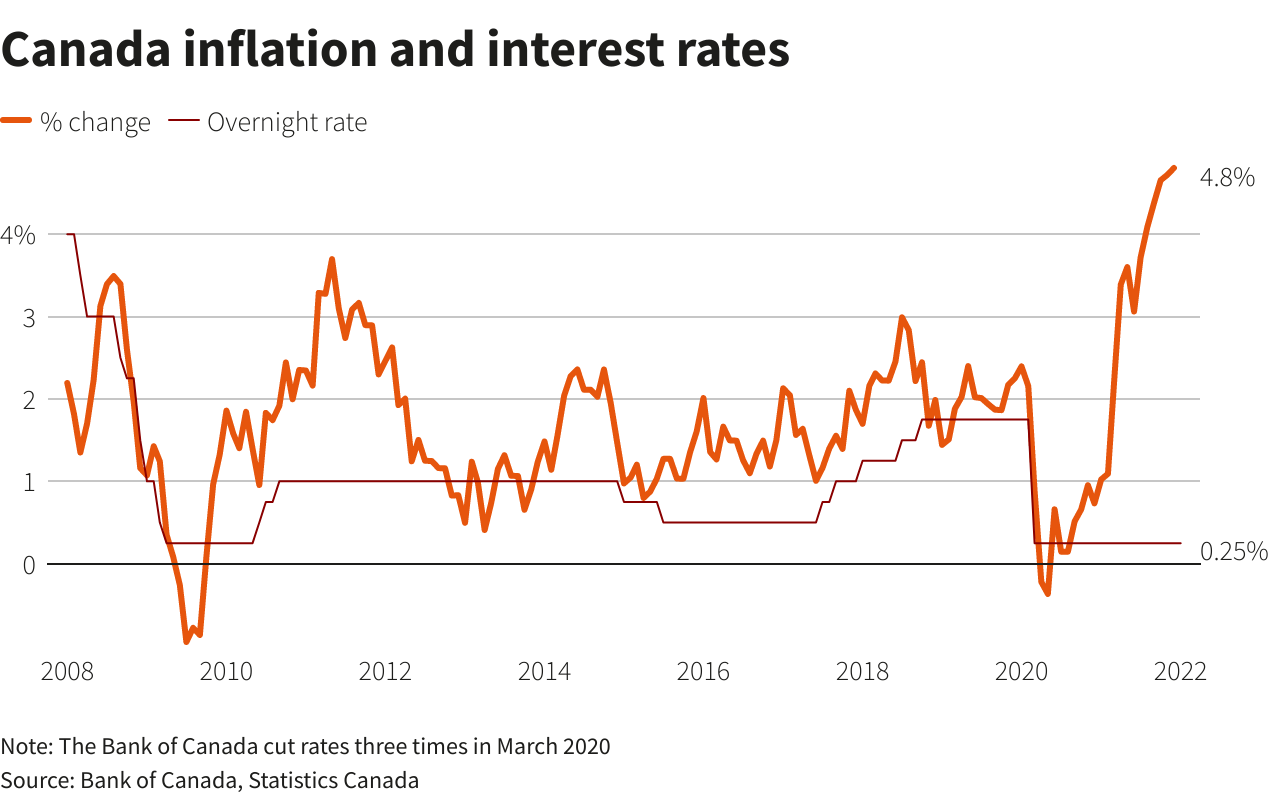

The bank kept its key rate at 025 well until the first quarter of 2022. The prime rate or prime lending rate is the interest rate a financial institution uses as a base to determine interest rates for loan products. This could follow the one.

The Bank of Canada has embarked on a series of supersized rate hikes this year in a bid to tame inflation but its upcoming policy rate decision on Sept. Markets are pricing in a 75-bps hike which would bring the Bank of Canadas overnight rate to 325 just above its 2-3 neutral range and into restrictive territory. The dates are as follows.

The Bank of Canada is widely expected to deliver yet another oversized interest rate hike next week lifting its policy rate into restrictive territory for the first time in two decades but bets. OTTAWA On Wednesday September 7 2022 the Bank of Canada will announce its decision on the target for the overnight rate. The Bank of Canada today published its 2023 schedule for the release of its policy interest rate decisions and quarterly Monetary Policy Report.

The Bank of Canadas latest interest rate decision has reinforced fears that the economy is headed for a recession that could cost some Canadians their jobs and keep worker wages stagnant. Each financial institution sets its own prime rate as a function of its cost of funding which in turn is influenced by the target for the overnight rate set by the Bank of Canada. Majority 76 of Finders panel predicted a 75bp rise.

The Bank of Canada increased its key interest rate by 100 basis points on July 13 2022 bringing the central banks policy rate to 250. Most panellists 69 agreed a more aggressive hike for July is the right move. See what it isand what it means for you.

Bank of Canada exchange rates are nominal quotations not buying or selling rates and are intended for statistical or analytical purposes. Economists expect the Bank of Canada to make another outsized increase in its interest-setting rate next month. This brought the Bank of Canada interest rate to 025.

2 days agoAll eyes will be on the Bank of Canadas interest rate decision this week which some say could be its last increase of the year and perhaps of this rate cycle. 11 hours agoBloomberg -- The Bank of Canada is set deliver a fourth consecutive outsized interest-rate hike to slow the nations economy and drag inflation down from four-decade highsMost Read from. 8 hours agoBank of Canada Governor Tiff Macklem taking part in a news conference in Ottawa.

It also reconfirmed the scheduled interest rate announcement dates for the remainder of this year. We are not a commercial bank and do not offer banking services to the public. Interest rate announcement and Monetary Policy Report.

Skip to content. 15 hours agoCanadas central bank is expected to raise its key overnight rate the fifth rate-hike this year as the Bank continues to struggle with inflation. The Bank of Canada raised the target for its overnight rate by an entire percentage point to 25 on July 13th 2022 a move not seen since 1998 and surprising analysts who expected a 75bps hike while signaling that it will hike interest rates further in the coming meeting to curb rising inflation.

The Bank is also continuing its policy of quantitative tightening. Some of Canadas major banks are forecasting the central bank will raise the key interest rate by three-quarters of a percentage point bringing it to 325 per cent. Governor Tiff Macklem and his team have increased borrowing costs four times since March in a bid to.

Canadas economy declined by 55 and inflation was below the 2 target during 2020. The majority 69 of the panel expect the. Stay up to date with BOC interest rate news.

Scotiabank Economics forecasts that the Bank of Canada will raise its benchmark policy rate to 200 by end-2022 and 250 by mid-2023. At the heart of the Bank of Canadas monetary policy is the target for the overnight rate. Bank of Canada Interest Rate Announcement.

Rather than being hawkish our forecast rate path would. 1 day agoBank of Canada expected to raise interest rate for fifth time at pivotal moment for economy. On 3 March 2022 the Bank of Canada started increasing interest rates first by 25bps to 050 as inflation started to soar due.

Canadian Interest Rates Treasury Bill Yields. 7 comes as the economic picture has started to shift. The Bank of Canada has raised its benchmark interest rate by the largest amount in more than 20 years sharply increasing the cost of borrowing in an attempt to rein in runaway inflation.

July 26 2022. This 100 rate hike the largest individual hike since 1998 follows up on two prior rate hike announcements of 50 basis points each in April and June 2022 which were at the time the largest individual. The Bank of Canada BOC is Canadas central bank and determines the monetary policy path and dictates interest rates.

The Bank of Canada is the nations central bank. A history of the key interest rate Over the years the Bank of Canada has adjusted the way it sets its key interest rate.

Holding Interest Rates Steady Bank Of Canada Keeps The Door Open For A Cut The Real Economy Blog

Bank Of Canada Raises Benchmark Interest Rate To 1 5 Noting Trade Tensions Cbc News

Bank Of Canada Makes Another Emergency Cut To Interest Rate Cbc News

Central Bank Rates Worldwide Interest Rates Bank Of Canada Boc

Bank Of Canada Raises Interest Rate To 1 75 Cbc News

Bank Of Canada Holds Interest Rate At 1 75 Wary Of Global Slowdown Cbc News

Comments

Post a Comment